Esta Ley dispone que a partir del mes de marzo el Programa no puede cancelar la elegibilidad a ningn beneficiario durante el estado de emergencia de salud decretada por el Secretario de Salud de Los Estados Unidos. Just under the wire on December 27 2020 President Trump signed the Consolidated Appropriations Act 2021 which extended certain provisions of the FFCRA but not all of it.

University Human Resources Families First Coronavirus Response Act

Note that the American Rescue Plan Act of 2021 ARP enacted March 11 2021 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and family leave for wages paid.

Families first coronavirus response act extension 2021. Increases the number of days of paid leave for self-employed from 50 days to 60 days. The FFCRAs paid sick leave and expanded family and medical leave requirements will expire on Dec. Families First Coronavirus Response Act FFCRA ends 31 Mar 2021 As you are aware the Families First Coronavirus Response Act FFCRA was implemented on 1 April 2020.

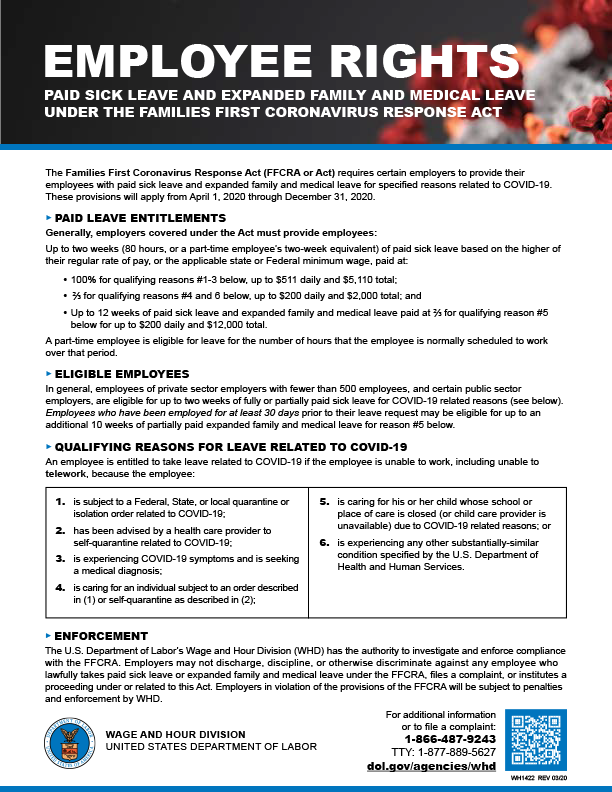

The Families First Coronavirus Response Act of 2020 FFCRA the first paid-leave of absence law to be enacted on a nationwide level became. Hoy el decreto de emergencia contina. Please visit the Wage and Hour Divisions FFCRA Questions and Answers page to learn more about workers and employers rights and responsibilities after this date.

The requirement that employers provide paid sick leave and expanded family and medical leave under the Families First Coronavirus Response Act FFCRA expired on Dec. Pursuant to the authority in Section 2202a of the Families First Coronavirus Response Act the FFCRA as extended by the Continuing Appropriations Act 2021 and Other Extensions Act PL 116-159 and based on the exceptional circumstances of this public health emergency the Food and Nutrition Service FNS is extending a nationwide waiver for area eligibility to continue supporting access to. The DOL issued guidance for employers on December 31 2020.

NIU first implemented the Family First Coronavirus Response Act FFCRA leave program on April 1 2020 to provide emergency sick leave and extended Family Medical Leave FMLA to NIU employees for reasons related to COVID-19. Extensions of the Families First Coronavirus Response Act Under the American Rescue Plan Act Thursday April 1 2021 On March 11 2021 President Biden signed into law the American Rescue Plan Act. However under the Consolidated Appropriations Act signed by President Trump on December 27 the employer payroll tax credit for paid sick and family leave under FFCRA was extended through March 31 2021.

Among the many changes ARPA extends the timeframe for employers to receive tax credits for voluntarily providing paid sick leave for COVID-19 and expands on other Families First Coronavirus Response Act FFCRA leave-related provisions. Extension of Family First benefits through September 30 2021. The Families First Coronavirus FFCRA was enacted in March of 2020 and was set to expire on December 31st 2020.

With the enactment of the American Rescue Plan Act of 2021 ARPA employers with fewer than 500 employees may continue to collect tax credits for voluntarily providing expanded leave originally provided under the Families First Coronavirus Response Act FFCRA. Extends to September 30 2021 for employer-provided paid sick and family leave established under the Families First Coronavirus Response Act FFCRA. Pursuant to the Families First Coronavirus Response Act the FFCRA PL 116-127 as extended by the Continuing Appropriations Act 2021 and Other Extensions Act PL 116-159 and based on the exceptional circumstances of this public health emergency the Food and Nutrition Service FNS is extending a nationwide waiver to support access to nutritious meals while minimizing potential.

Department of Labors Wage and Hour Division WHD today announced additional guidance to provide information to workers and employers about protections and relief offered by the Families First Coronavirus Response Act FFCRA. On March 11 2021 the American Rescue Plan Act of 2021 ARPA was signed into law. The FFCRA leave benefits expired under the original statute on December 31 2020.

Qualified Family Leave covered wages increases from 10K to 12K per employee. As we discussed in our previous alert the FFCRAs mandatory leave provisions requiring covered employers to provide. FAQS ABOUT FAMILIES FIRST CORONAVIRUS RESPONSE ACT AND CORONAVIRUS AID RELIEF AND ECONOMIC SECURITY ACT IMPLEMENTATION PART 44 February 26 2021 Set out below are Frequently Asked Questions FAQs regarding implementation of the Families First Coronavirus Response Act FFCRA the Coronavirus Aid Relief and Economic Security.

FFCRA provides associates with paid sick leave for reasons related to the coronavirus COVID-19. Extends through March 14 2021 a provision in the CARES Act which amended the Families First Coronavirus Response Act to provide federal support to cover 50 of the costs of unemployment benefits for employees of state and local governments and non-profit organizations. The American Rescue Plan Act ARPA effective April 1 2021 extends the provisions created by the Families First Coronavirus Response Act FFCRA through September 30 2021 and expands the qualifying reasons to use emergency paid sick.

Heres whats happened. The American Rescue Plan Act of 2021 enacted March 11 2021 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and family leave for wages paid with respect to the period beginning April 1 2021 and ending on September 30 2021. El 18 de marzo se firm la ley federal Families First Coronavirus Response Act FFCRA Pub L.

FFCRA CAA and now ARPA. Tax Credits for Paid Leave Under the Families First Coronavirus Response Act for Leave Prior to April 1 2021. The American Rescue Plan Act ARPA that was recently signed.

WASHINGTON DC The US.

Covid 19 Updates Claiborne County

Https Portal Ct Gov Media Opm Pca Paid Leave Paid Leave Extension Communication To Consumer Employers 4 1 21 Final Pdf

Families First Coronavirus Response Act Ffcra Department Of Health State Of Louisiana

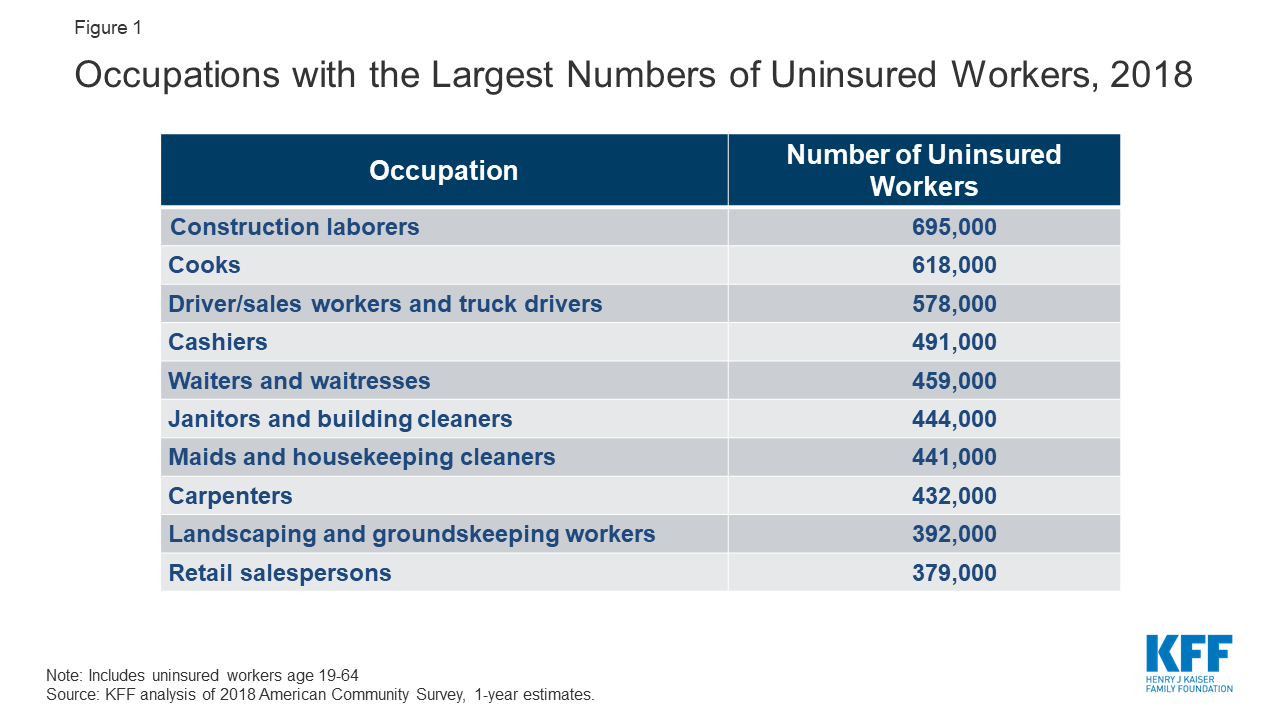

What Issues Will Uninsured People Face With Testing And Treatment For Covid 19 Kff

Https Dhr Delaware Gov Policies Documents Covid19 Policy Pdf

Ffcra Extended Through September 30 2021 With Some Key Amendments Cdf Labor Law Llp Jdsupra

Ffcra Leave Expanded Under American Rescue Plan Mvp Law

Families First Coronavirus Response Act Signed By Pres Trump

Families First Coronavirus Response Act And Other Coronavirus Information For Employers Printing United Alliance

Guidance On Taking Leave Uf Human Resources

The Families First Coronavirus Response Act Summary Of Key Provisions Kff

Families First Coronavirus Response Act New Federal Paid Leave And Other Requirements Impacting Employers Sgr Law

Extensions Of The Families First Coronavirus Response Act Under The American Rescue Plan Act Varnum Llp

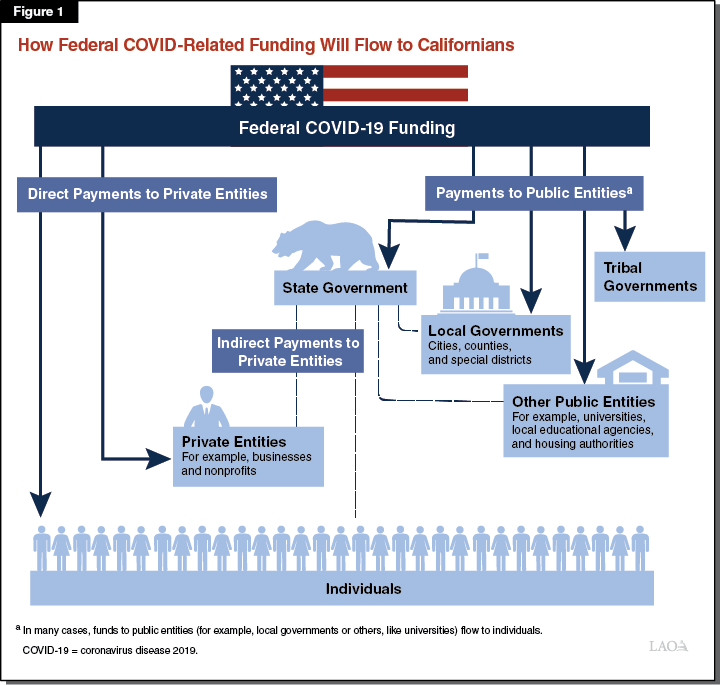

Federal Covid 19 Related Funding To California

Https Dhr Delaware Gov Policies Documents Covid19 Fpsl Form Pdf

Flc Analysis Of Coronavirus Response And Relief Supplemental Appropriations Act Of 2021

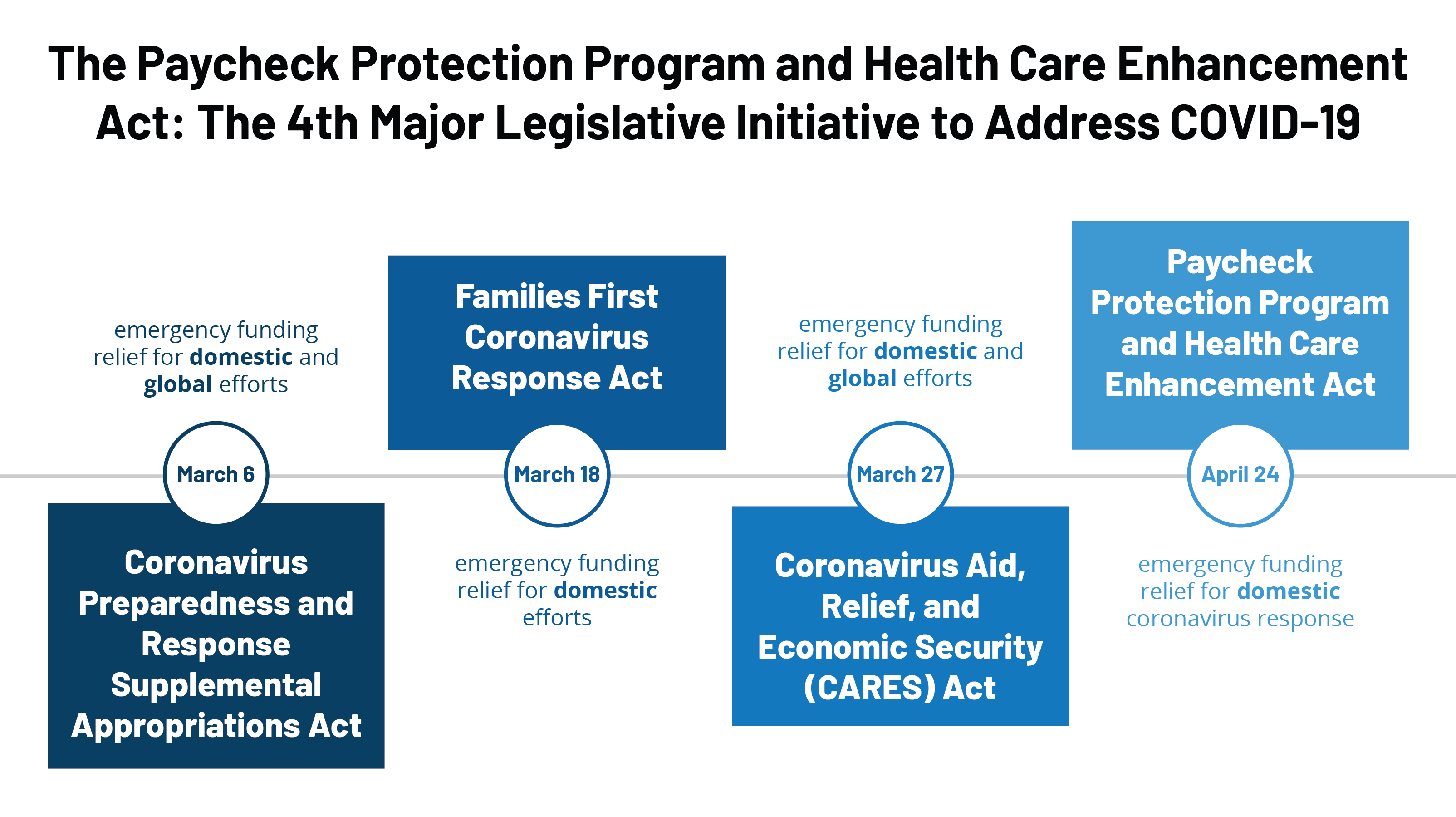

The Paycheck Protection Program And Health Care Enhancement Act Summary Of Key Health Provisions Kff

How Does The Families First Coronavirus Response Act H R 6201 Impact Employers

The Families First Coronavirus Response Act Summary Of Key Provisions Kff